By: Henry Coster

Being a college student is an undoubtedly great experience, however it comes with its downsides. One of the biggest of these downsides is the cost, and in recent years, it has continued to rise.

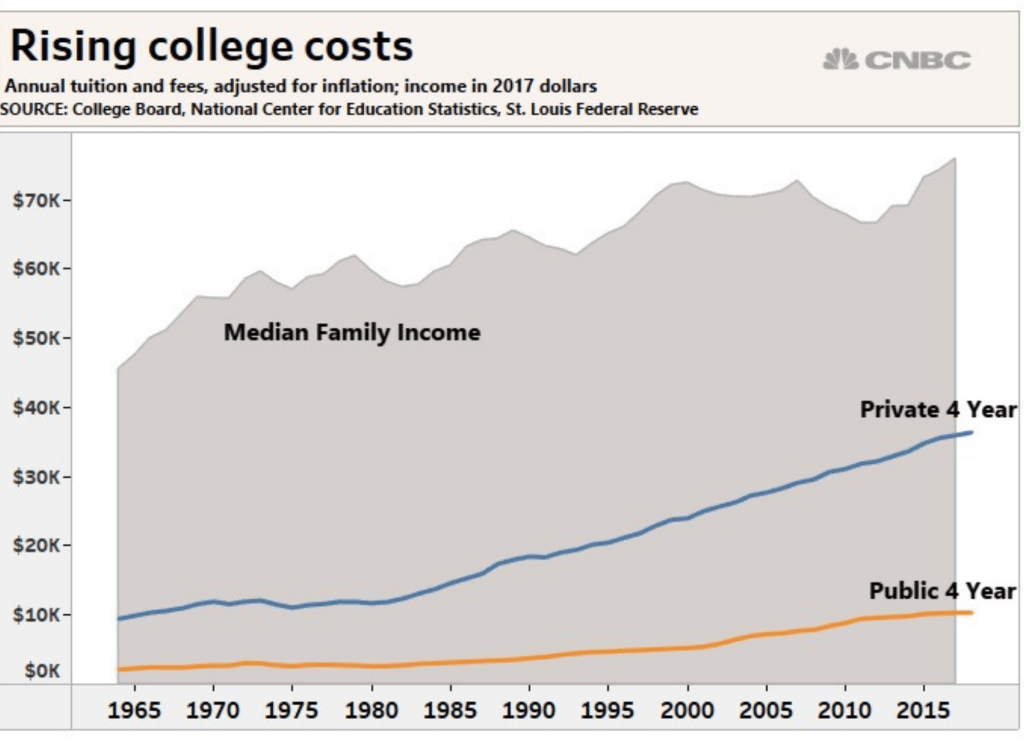

Both public and private universities have seen an increase in the cost of tuition fees for students. For the 2024-25 academic year, the average published tuition and fees for full-time undergraduate students at in-state public four-year institutions was $11,610, up about 2.7% from $11,310 in 2023-24 (College Board, 2024). This was the same for private schools, up about 3.9%. This shows a definite increase in the cost for students, and if fees continue to rise by these small percentages each year, it could pose big problems for many aspiring college students as to whether they can afford to go to college.

Another factor which has played into the overall cost increase involves fees for textbooks and online access codes. The estimated cost of books and supplies for a college student was about $1,370 annually. (College Board, 2024). Although this may not seem as significant as the last fee, additional costs like these can still determine whether a student can afford to go to college or not.

Despite this, the recent rise of digital and open educational resources has allowed students to access textbooks online such as OpenStax, as well as online videos and tutorials such as Khan Academy. This is helping students to save money in this area which can have a positive impact on their education. It also provides them with more resources to help foster their learning once in college.

One element that might not be talked about as much is the role of student income and employment. As we know, many students opt to work in part time roles in order to cope with the extreme costs of college life. In October 2023 the employment–population ratio for college students ages 16-24 was 44.3%. (U.S. Bureau of Labor Statistics, 2024). This just amplifies the sheer number of students who feel like they are required to work in order to survive during college.

However, this also poses its own challenges. Many students can find it difficult to balance their work life with their academics, and this can result in a decline of their grades and potentially other factors such as their mental health and well-being.

So, we can see that increasing college fees can create a knock on effect: Increasing costs can lead to students feeling the need to get a job on top of studying. This can lead to them feeling overwhelmed which can take a psychological toll on their mental health. This, paired with a lack of wellbeing support for students within colleges, can pose a serious issue for college students.

Jake Hotka is a sophomore student here at WVWC. He commented on how he has coped with the increased tuition fees here at Wesleyan since last year: “I worked a lot over summer so that I wouldn’t have to rely on my parents as much for money whilst I’m here. I would like to get a job on campus but I don’t want to overload my work schedule.”

Hotka also commented on his own issues he’s had to face with the costs this year: “I had to buy two textbooks for my classes which set me back a fair bit, however when possible I try to find open resources online in order to save some money.”

Overall, it is clear that there are many issues surrounding the increasing costs of going to college. How long will this keep rising until students can no longer afford to go to college? Who knows? But if it carries on like this, it might come around sooner than you think.

Credit: NerdWallet, inc.

Leave a comment